After an intense few days of volatility at the end of last week/beginning of this week, Bitcoin is consolidating close to the $25,000 level as market participants mull what’s next for the world’s largest cryptocurrency by market cap. Bitcoin’s recent decoupling to US equities has got some thinking that if concerns regarding financial stability in the US and elsewhere continue to rise, this could continue to boost the Bitcoin price.

Bitcoin, a decentralized, independent peer-to-peer payments network is viewed by many as a safe alternative to the fiat-based, central bank-centered fractional reserve system. Another potential tailwind for Bitcoin could be if next week's Fed meeting is decisively dovish (assuming that Fed officials fear a hawkish message could further roil the banking system).

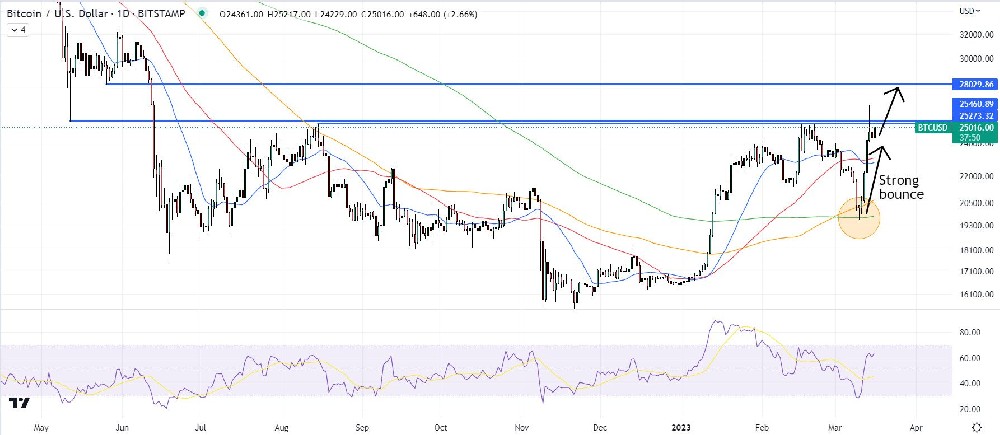

Meanwhile, BTC’s recent strong bounce from its 200DMA and Realized Price under the $20,000 level is another tailwind. The fact that Bitcoin managed to crack above key long-term resistance in the $25,200-400 area earlier this week means the door is open to a run higher towards the next resistance area around $28,000 and perhaps even a test of $30,000.