We’ve heard it all - Bitcoin has increasingly been used to counter the drawbacks of fiat. Whether it is used to hedge against inflation or to secure one’s savings, Bitcoin has shown the world that it is an attractive digital asset and a viable alternative to traditional currencies. With the ever-evolving nature of cryptocurrencies globally, the digital landscape of Turkey has also matured. Its population has come to embrace cryptocurrencies as a whole, with cryptocurrency evangelists raising awareness of this new investment.

In Istanbul, for example, a cryptocurrency community by the name of Altcointurk has been set up to educate people on cryptocurrencies and their benefits. With the depreciation of the Turkish lira, many have resorted to storing and preserving their funds in Bitcoin and other cryptocurrencies. In 2020, Bitcoin experienced a boom during the financial crisis that saw the lira’s value lose significantly in value. In parallel with this, inflation has been ongoing. In Turkey, it hit a two-decade high, surging by over 30%.

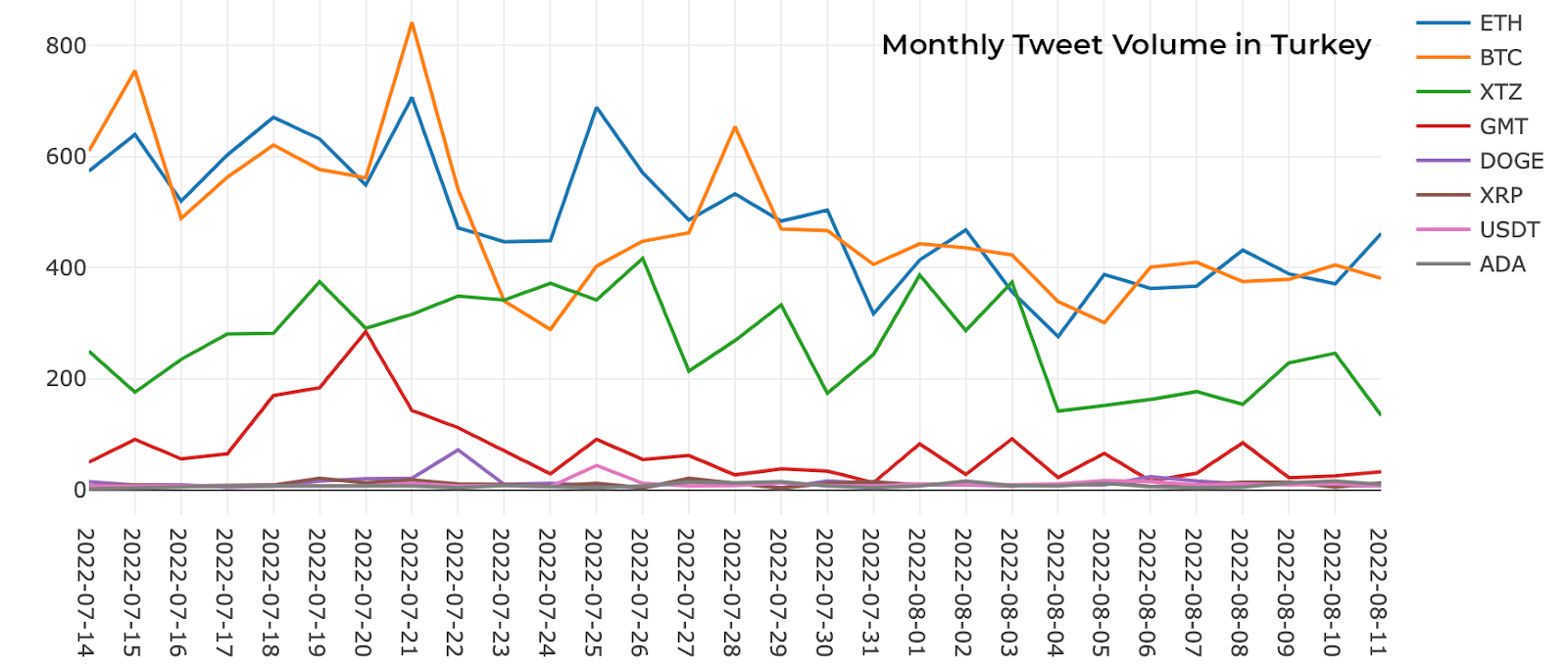

The most popular cryptocurrencies in Turkey

While many other investments such as gold have become increasingly popular in light of the economic recession, many young people have grown to see cryptocurrencies as the ideal investment. Among all the digital assets, Bitcoin (BTC), Ethereum (ETH), and Tezos (XTZ) are among the most popular cryptocurrencies among investors and traders in Turkey, per data from The Tie. Tether (USDT) stablecoin also appears to be a popular asset often discussed (more on this later).

According to a Forrester report , more people in Turkey “have been using Bitcoin over the last 12 months, increasing their use of Bitcoin to make (42%) and receive (33%) payments and/or transfers.”

In Turkey, the main appeal of cryptocurrency seems to be its hedge against inflation which has been rampant since the '90s.

Hedging against inflation with crypto

While approximately 79% of the people owning cryptocurrencies are male, there is 21% that are female. Sima Baktas, the founder of CryptoFemale Turkey:

“When you talk about inflation, it hurts me. We currently have 75% of inflation right now in Turkey. Maybe that’s why Turkish people love crypto. Because if fiat currencies lose their value on a daily basis, people will slowly lose trust in fiat currencies.”

She further revealed that many people have taken a liking to USDT over the US dollar - despite the fact that the stablecoin is tethered to USD. USDT enables many to trade freely, transact digitally, and send money globally. This in itself represents a form of financial freedom, she explained.

Furthermore, USDT enables digital transactions to be processed with fewer fees in comparison with traditional currency conversions.

A growing interest in blockchain technology

With the growing use cases of digital currencies and the entry of Bitcoin into mainstream finance, Turkish people have been quick to jump on the trend. Bitcoin is not the only interesting asset explored, but also blockchain technology. Many have taken it upon themselves to explore the use cases of blockchain. Blockchain Istanbul Center, for one, is an organization in Turkey dedicated to exploring the application of blockchain technology in one’s daily life. Fintech has been a growing topic of interest, with many communities and organizations driving the belief that blockchain and cryptocurrencies will disrupt the current financial system and boost innovation.

Cryptocurrencies, a gray area in Turkey

Despite the rising popularity of digital assets among people in Turkey, the Turkish government seems to have adopted another view. In 2021, President Recep Tayyip Erdoğan declared that “we are in a war against Bitcoin.” Erdoğan launched a program that encouraged Turkish citizens to store their funds in banks and invest in lira savings. The President also unveiled that a central bank digital currency (CBDC) is currently being tested. He publicly stated during an AMA hosted in Mersin, Turkey,

“We have absolutely no intention of embracing cryptocurrencies [...] Because we will move forward with our own currency that has its own identity.”

CBDCs in a crypto world

While some countries utilize cryptocurrencies for investments and to secure wealth, others use it on a daily basis - to survive. In Nigeria, cryptocurrencies like Bitcoin are heavily utilized by the population because there is a general distrust in the government. To counter the growing popularity of digital assets, the Nigerian government launched its own CBDC, dubbed the e-naira. However, many in Nigeria still believe in the potential of cryptocurrencies and utilize it instead of the e-naira to shield themselves against political corruption.

Leading by example - the Philippines

With the evolution of digital assets, there is also bound to be an influx of central bank digital currency production. Many countries such as Nigeria and the Bahamas have already launched their own central bank digital currency. Whether CBDCs and cryptocurrencies will be used as much as fiat in the future remains to be seen. One thing is certain, however - digital assets are here to stay. Their potential in emerging markets such as Turkey is increasingly being recognized and is growing by the day. Countries such as the Philippines have begun paving the way for how cryptocurrencies can be integrated into one’s daily life. Over the years, as digital assets mature, we will inevitably witness the impact of digital assets on a global scale.